Introduction

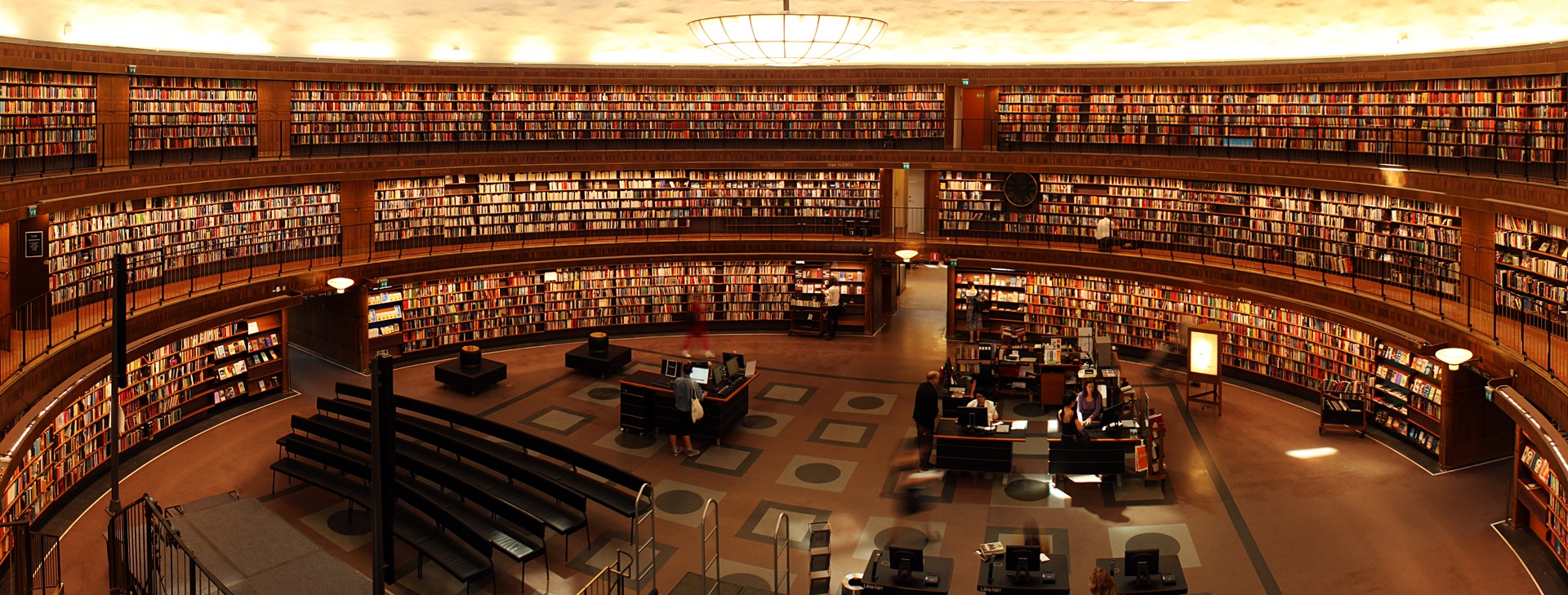

What makes an F1 auto racing champ? Is it the auto? Is it the modern technology that entered into developing the engines? No, it is the motorist. The driver’s confidence around edges and persistence in the face of daunting difficulty by various other motorists makes a champion. Likewise, it is the investor that makes the difference in stock and alternative trading. It is the supply or alternatives traders’ confidence in their chosen methodology as well as their perseverance despite daunting cost changes that makes a champion stock or options investor.

Trading Self-confidence as well as Trading Self-control are one of the most essential facets of trading psychology that makes millionaire stock or options investors. They are also the major reason that numerous supply as well as alternatives traders fall short as well as break their bank.

Trading Self-confidence

Trading confidence is a psychological self-confidence financial account in every trader and also trading discipline identifies if you down payment or withdraw from it. Trading self-confidence is what makes it possible for every stock and options traders to perform trades according to their picked method confidently and also to stick to the video game regardless of losses knowing that they will at some point make more success than losses.

Trading confidence is a financial account which you can either deposit to or withdraw from. Each time you shed money, you take out from your trading confidence and each time you generate income, you transfer to your trading self-confidence. When your trading confidence is absolutely no or bankrupt, you will certainly find yourself thinking twice prior to every profession while visualizing the discomfort if the trade turns out a loser once more. You will have sleep deprived nights and will rush out of professions at the extremely first indication of threat, making unneeded losses. When that happens, it is the time to go back to paper as well as re-examine the way you have actually been trading.

Factors Affecting Trading Confidence

A significant factor of your degree of trading confidence is the quantity and also nature of cash that you have to patronize. The even more cash you can manage to shed, the higher your initial level of trading confidence. Supply as well as alternatives traders whom can afford to shed just very little cash would usually have extremely reduced level of trading self-confidence as every loss takes a significant bite out of their trading confidence financial institution.

Again, you need not shed all your cash to lose all your trading self-confidence. Some supply as well as alternatives traders no more feel confident enough to trade when their account decrease by 30%, while some reach that level of confidence bankrupt just when their account go down by 70%.

The nature of money you have to trade with likewise determines your beginning trading self-confidence. If you are trading with excess money which you do not require, after that your degree of trading self-confidence would be very high. Actually, your trading self-confidence might still be high even if you shed all that money. On the other hand, if you are trading with obtained money which you need to repay in installation and with passion, your trading confidence would certainly be exceptionally low as every loss makes it harder for you to pay the money back.

Trading Discipline

Once you are sure that you have a tried and tested as well as effective method, you will require Trading Discipline to make certain you adhere to the guidelines and also profession only when entry needs are fully fulfilled. Without trading discipline, you will end up ruining any successful method, bring about a withdrawal of your trading self-confidence.

Trading Technique consists of Perseverance and a Tranquility, Objective mind.

Every trading method trades just when certain arrangements or policies are met. Without trading technique, you will not have the patience to wait for such arrangements or policies to be totally fulfilled prior to trading as well as every time you damage the policies, you raise your probabilities of shedding and also every loss withdraws from your trading self-confidence. Consequently, do not make “enjoyable” or “speculative” professions by jeopardizing guidelines as shedding under such conditions do withdraw from your trading self-confidence also.

Trading Self-confidence & Complacence

A difference has to be made below relating to trading self-confidence and complacence. Complacence comes not from a high trading self-confidence yet from a complete lack of trading self-control. Complacence constantly leads to a fast as well as total bankrupt of trading self-confidence, so, be specific to comprehend the difference.

Please hop over to their page for more information about traits of great traders.